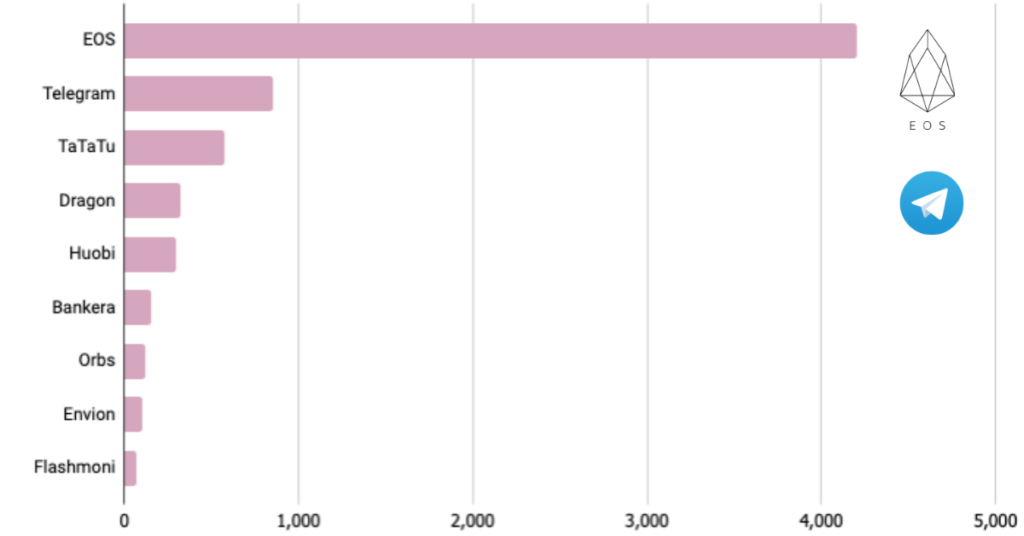

A 4,2 Billion Dollar Initial Coin Offering.

Initial Coin Offerings (ICOs) has become a very popular fundraising method used primarily by startups wishing to offer products and services, usually related to the cryptocurrency and blockchain space. Some has been very successful while most of them don’t survive more than four to six months. I know many of my fellow entrepreneurs trying ICO’s as an alternative fundraising method but it ain’t as easy as it might sound and usually, an 80 to 95 % fails and almost 70% of tokens are now valued less than what was raised during their ICO meaning $8.2 billion are now worth just $2.2 billion. What has been bad for the industry is its unregulated format were boost values based on nice presentations, or promising the treasure at the end of the rainbow and failing on delivering those promises, brings the credibility of an ICO to an all-time low. Investors need to do a better job of research before investing in currencies to enjoy the successful ones like TRON, IOTA, TEZOS or not to mention EOS.

These were the leading ICOs worldwide in 2018.

Startups, on the other hand, need to understand the basics of an ICO before you chose it as a fundraising tool. Regardless of a majority of failures, there are some very successful ones such as the EOS raising an incredible 4,2 Billion Dollars. Block.one and its blockchain platform called eos.ios multibillion-dollar fundraising was the next biggest offering of that type when investors still didn’t know where the majority of that capital will be used. More or less based on hype and a promise that its founders, who have run other well-known blockchain projects, can repeat their success.

Blockchain ICO projects: funds raised worldwide 2017-2019

What Is an Initial Coin Offering (ICO)?

An Initial Coin Offering (ICO) is the cryptocurrency industry’s equivalent to an Initial Public Offering (IPO). ICOs act as a way to raise funds, where a company looking to raise money to create a new coin, app, or service launches an ICO. Interested investors can buy into the offering and receive a new cryptocurrency token issued by the company. This token may have some utility in using the product or service the company is offering, or it may just represent a stake in the company or project similar to stocks.